The earnings report enables publicly traded companies to report their financial results during a specific period, usually a quarter or a year. Investors lean on earnings reports to better understand a company’s financial performance.

Companies also use earnings reports to not only present financials but also provide investors with explanations about operations, new products and service lines, industry competition or regulatory challenges. Such qualitative details help round out a picture of a company’s performance.

An Important Step in the M&A Process

Unfortunately, the quality of a company’s earnings is difficult to define and, although there are no definitive criteria by which to evaluate it, there are many factors that can be considered in assessing the quality of earnings. In general, the quality of earnings can be summarized as the degree to which earnings are cash or noncash, recurring or nonrecurring, and based on precise measurements or estimates that are subject to change.

“Evaluating the quality of earnings will help the financial statement user make judgments about the ‘certainty’ of current income and the prospects for the future,” notes Deloitte.

As such, the crafting of a quality of earnings report is an important step in the due diligence process of an M&A transaction because it adds an extra layer of credibility. It articulates the thought and logic of the earnings report, even for a company that has been issuing earnings reports for many years. More than simply addressing potential issues, it can also defend positions and provide the acquiring company with much more insight.

Evaluating Quality of Earnings Reports

There are various indicators in the financial statements that an acquiring company involved in an M&A transaction can use to assess a target company’s quality of earnings. Some of these indicators include the following:

- Consistency and application of accounting policies from year to year or quarter to quarter

- Degree of estimation or subjectivity in determining earnings

- Trend in reserve balances

- Transparency of footnote disclosures

- Complexity of or anomalies in the management discussion and analysis

- Discussion of nonrecurring, unusual transactions

- Presence of pro forma measures of earnings

- Disclosure of related-party transactions

- Ratio of net income to cash from operations

- Uncertainties and contingencies disclosed in the footnotes

This is not a complete list, and a review of earnings of companies in particular industries may offer unique perspectives. Many industries have measures that are widely used and commonly accepted.

Those involved in an M&A transaction and who are evaluating the target company’s earnings report should not rely on a single indicator to assess overall earnings quality.

Additionally, some outside reports can be helpful in assessing the quality of a company’s earnings reports. For example, press articles and equity research reports of the target company can also help round out an assessment of the quality of earnings, as others have had access to the company’s financials and have performed their own analyses.

Safely Sharing Earnings Reports

While earnings reports for public companies are freely available, those for private companies are not, and so privacy is needed when sharing with third parties. Further, regardless of public or private status, there may be additional company data that needs to be shared with a small, limited group in order for the acquiring company to perform its thorough due diligence in anticipation of an M&A transaction.

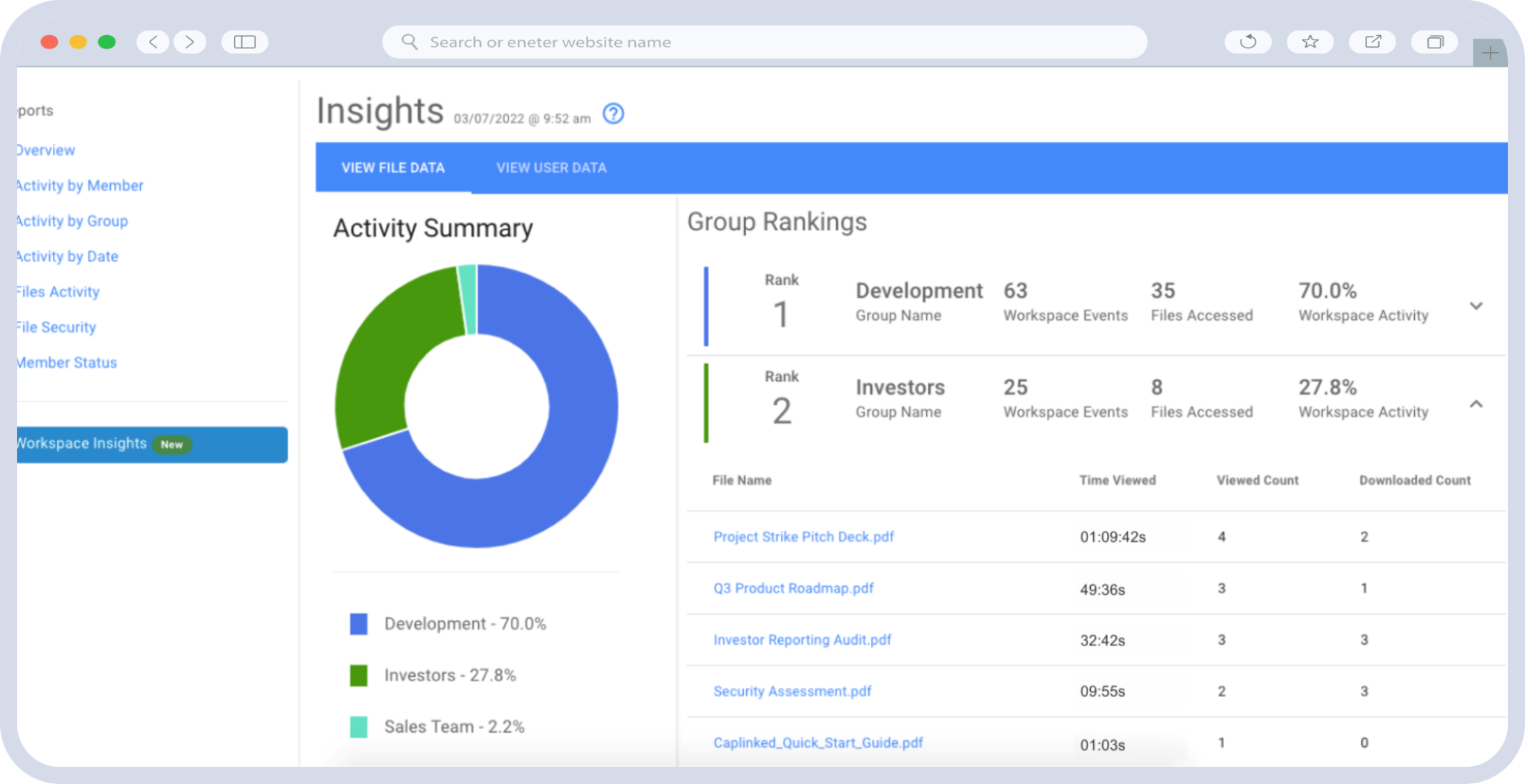

More than simply offering cloud document storage and management, a virtual data room (VDR) provides the privacy, safety and organization needed by companies sharing sensitive data and documents. A VDR provides both parties with 99% uptime and the ability to access documents and data anytime, anywhere, and on any device.

As they engage in M&A transactions, organizations should consider an enterprise document security solution like Caplinked that has years of experience providing data rooms for organizations needing privacy, security and strong document management. Start your free trial today.

Jake Wengroff writes about technology and financial services. A former technology reporter for CBS Radio, Jake covers such topics as security, mobility, e-commerce, and IoT.

Source

Deloitte – Quality of Earnings: Focus on integrity and quality